Category: The Credebt Exchange® Story

Welcome to Credebt Exchange Blog

Credebt Exchange® enables service and goods providers to offer their invoices as Exchange Traded Receivables [ETR] for sale on the Exchange. These ETR are attractive to Investors and when purchased on the Exchange, this provides Alternative Working Capital to the Originator/seller. A key objective for Credebt Exchange® is to achieve rates that are comparable to, and preferably less than, other commercial finance lending rates. By selling ETR, the trading organisation is avoiding the need for loans and/or credit facilities by using the ETR to provide Alternative Working Capital

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

50+ Retail Investors

Today the Exchange received funds from it’s fiftieth Retail Investor. Since the first date of trading on 4 July of his Year (see article: First RSA/RPA Trade Executed), achieving 50 Retail Investors demonstrates a strong appetite amongst the investment community for strong, short term cash-equivalents such as ETR….

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

2013-Q3 ETR Briefing

Exchange Traded Receivables [ETR] are invoices issued under Contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at Q3, Credebt Exchange® held RPA of €3.2m, with €1.7m contributed during the quarter. The full spectrum of available ETR was utilised and all currency exposure was hedged

In September, Credebt Exchange® introduced Instalment ETR [i-ETR] with Standard & Poor’s AA- or X2A Long-Term rating. i-ETR are invoices under Contract payable on an instalment basis (e.g. insurance premiums/asset purchases)

Performance

2013-Q3 was the first quarter of trading for Credebt Exchange®. Debtor numbers to the end of September were circa 200. Daily volume rose sharply with total recorded trades in excess of 1,300+. Highest single value trades were in July and September at an average of € 0.4m. Current RSA valued at € 13.1m+

Trend

Yield continued to trend downwards during the quarter, reflective of prevailing deposit rates. Volume of Originator trading continued a steady trend upwards with Investor demand slowing in August and returning to steady growth in September. Outlook for Q4 is medium to strong with immediate, additional capacity for RPA contracts of €3-5.0m

† Investment quality is a combination of Investment Grade [IG] organisations & other credit worthy organisations, as determined by AIG and other credit rating providers, from time to time

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

Unaffected by Seasonality

The Summer months tend to be the slowest for most Originators (and indeed Investors), however, August continues the steady growth experienced in Q2. The performance demonstrates that the initial Members of …

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

First RSA/RPA Trade Executed

Volume trading in Exchange Traded Receivables [ETR], has been strong using Revolving Sales Agreement [RSA] block and buy-out trades to increase market penetration. Little, or no, initial resistance in the market. Deals are delivering on Investor Revolving Purchase Agreement [RPA] …

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

Membership, Fees & Charges

IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

Credebt Exchange® aims to be clear and transparent on the how it deducts charges (i.e. fees and commissions) from payments to any Member account. Before examining any deductions from a Member account, the Originator should log in to their account and view the Important Information items listed on the Exchange Trade Centre | Dash Board (access to the Exchange Trade Centre is restricted to Members only) The information provided here is required reading.

There is also additional information in all of the articles in the Credebt Exchange® Tips & Help public section of this web site. If any aspect of what is documented is not clear, Originators are invited to submit questions to Support using the Support & Customer Care Form. Questions submitted using this form are regularly added to the Frequently Asked Questions, or FAQ, section of this web site.

Combining the Frequently Asked Questions, the articles contained in this section, the Credebt Exchange® Tips & Help and the Exchange Trade Centre | Dash Board with the documentation sent to all Originator Members, should provide a comprehensive understanding of the service. Originators and all Members are encouraged to communicate their views to the Customer Care Team.

The most efficient way to communicate with Credebt Exchange® is by using the Support & Customer Care Form. All submissions are responded to within 24-72 hours.

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

Exchange Fees & Charges

IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

In accordance with the Credebt Exchange® Master Agreement sub section 6.13: “The Account Bank will draw any fees and/or commissions that the Member owes to Credebt Exchange® from the relevant Member Account. Credebt Exchange will provide the Member with an electronic invoice of such fees to the Member.” Sub section 6.13 also states: “In the event that a Member does not pay all amounts owed to Credebt Exchange, Credebt Exchange shall have the right to set-off any amounts then owed by the Member to Credebt Exchange against any amounts then or thereafter due to the Member and/or Credebt Exchange shall have the right to deduct any outstanding amounts due to Credebt Exchange from any Collections in respect of a Traded ETR, or from the Member Account, in respect of that Member.”

Fees are liable for VAT and electronic invoices are issued for each charge that may include a:

- Arrangement Fee – one-time setup charge for arranging Membership as indicted on the RSA Offer

- Debtors Ratings Fee – €11.75 charge for checking each Debtor’s credit rating when requesting an RSA Offer

- Digital Certificate Fee – annual digital certificate charge as indicted on the RSA Offer

- Membership Fee – monthly charge for Exchange Membership as indicted on the RSA Offer

- Posting Fee – discretionary charge per posted ETR as indicted on the RSA Offer

- Collection Charges – discretionary charge for providing credit management and/or debt collection services

Fees are charged on the first ETR sales transaction conducted by the Originator each month. In the absence of any sale of ETR in any month, in accordance with the Credebt Exchange® Master Agreement, fees may be deducted from ETR Settlement or Reserve payments. To view specific RSA Offer(s) and invoices for all fees charged on a Member account, login to the Exchange Trade Centre | Dash Board and use the My Reports link on the left side of the Exchange Trade Centre | Dash Board.

All ETR trading is subject to the Discount and Commissions specified in the RSA Offer. The total Discount is easily calculated as explained in the Calculate the Cost of Funds article. Neither the Discount nor the Commissions are liable for VAT and no invoice is required because these are an integral part of the Purchase Price and the Reserve calculations. These are automatically deducted from transaction payments and may include a:

- Processing Commission – deducted from the Purchase Price, Reserve and other payments due

- Trade Commission – deducted from every payment transferred to the Originator

- Over Allocation Commission – discretionary surcharge for substantial underutilisation of allocated funds

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

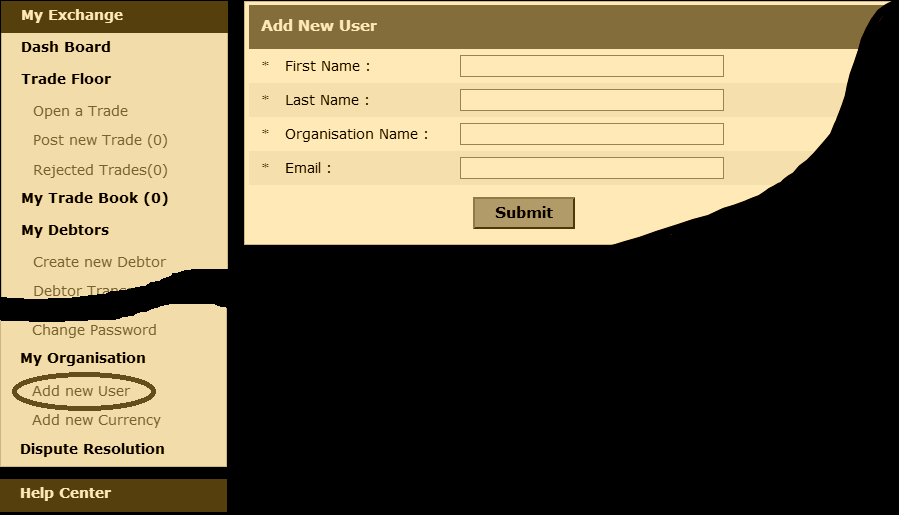

Add New User

IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

In many instances there is more than one user in an Originator organisation that requires access to the Exchange Trade Centre. To add a new Debtor, use the Add new User interface that is accessed directly from the Originator Dashboard using the yellow ‘Add new User’ menu item from the left side menu: My Organisation -> Add new User.

When this form is submitted, the new user receives an email inviting them to complete a simple form and submit it. Once the request is approved, the user will receive a second email to complete the process. Once completed, they too will have access to the Exchange Trade Centre.

IMPORTANT:- The new use must complete both forms using the same web same browser, otherwise their digital certificate will not work and they will not be able to access the Exchange Trade Centre.

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

Investor Demand

After only six weeks, Investor demand for Exchange Traded Receivables [ETR], is ahead of expectations and indications are that demand will continue into Q3 at a steady pace. This strong positive performance indicates that ETR placement and yield…

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |

We’re Traders, Just Like You

& We Want to Work With You

More Posts Like This

2023-M10 Investabill® Briefing

2023-M09 Investabill® Briefing

2023-M08 Investabill® Briefing

ETR OnRisk with AIG

Exchange Traded Receivables [ETR], officially went ‘OnRisk’ with AIG as finance trade, commercial risks attaching on an insurance contract with specific reference to the Master Agreement …

| BANK BORROWING | TRADE CREDEBT® | |

|---|---|---|

| No personal guarantees * | ||

| No liens/debentures * | ||

| Quick application | ||

| Quick decision | ||

| Commercial perspective | ||

| Consultative process | ||

| No credit limits | ||

| Light on administration | ||

| Quick access to cash | ||

| No exit fees * |